Target’s latest report for the economic changes in Egypt during quarter 3 according to CAPMAS, the urban inflation rate in September reached an all-time high of 38 % YoY, up from August’s 37.4%.

The surge in food and beverage (F&B) prices, which is the largest component of the inflation basket accounting for 35.7 %, is responsible for the jump in the urban inflation rate.

In an attempt to contain high inflation, Prime Minister Madbouly partnered up with the private sector this week to decrease the prices of seven essential goods by 15 % to 25 %.

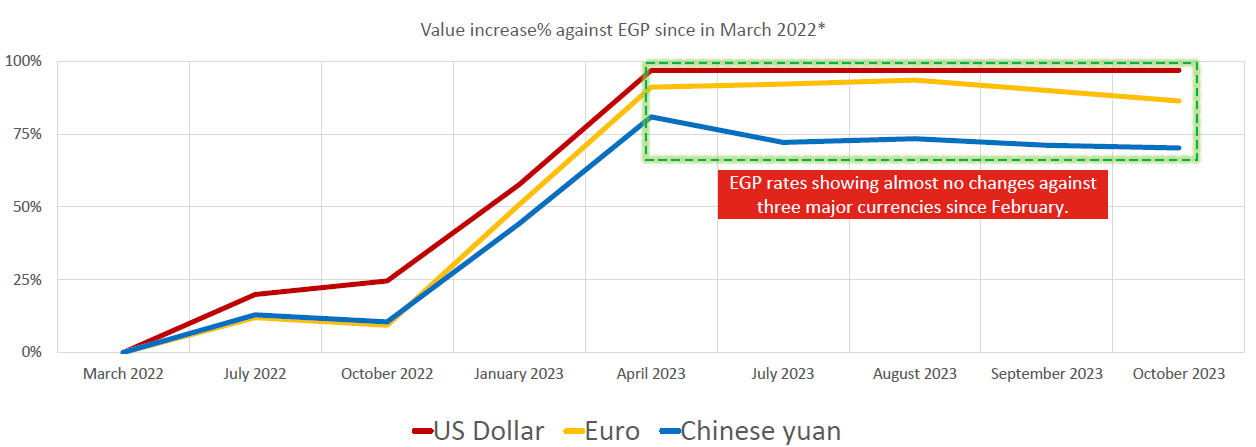

Exchange Rate: The Calm Before The Storm?

The EGP official exchange rate has been kept stable since February, while the unofficial rates did fluctuate.

Devaluation will once again be on the agenda for policymakers, with IMF head Kristalina Georgieva warning that the further down the road we kick the decision, the more we will “bleed” our reserves.

The IMF has delayed two reviews of our USD 3 bn assistance program after we failed to meet several conditions of the loan, including a commitment to implement a fully flexible exchange rate. Experts expect the Central Bank of Egypt to allow the currency to float freely to get the Fund’s sign-off and unlock the next two tranches of the loan, though most analysts don’t expect this to happen before the presidential election in December.

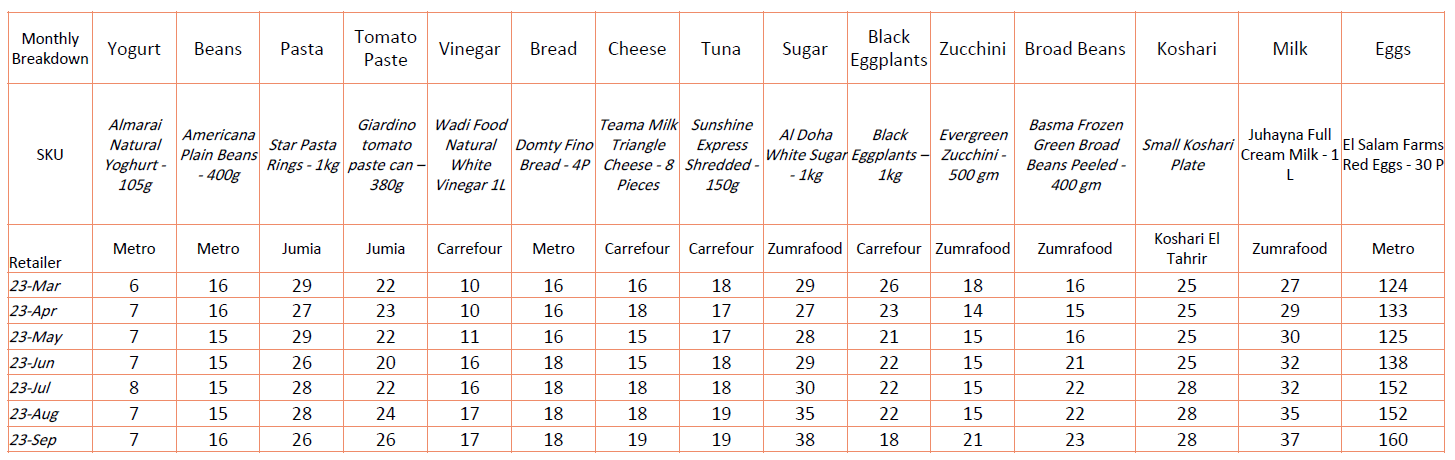

Consumer Goods

The Consumer Price Index (CPI) in Egypt, which measures changes in the prices paid by consumers for a basket of goods and services, has seen significant changes in 2023. By September 2023, the CPI had increased to 183 points, up from 179.50 points in August. This indicates a continued trend of rising consumer goods prices throughout the year.

We have identified a basket of essential goods for Egyptian households and monitored their price changes throughout the past 7 months. Vegetables seem to be the most volatile items along with a significant increase in Sugar prices.

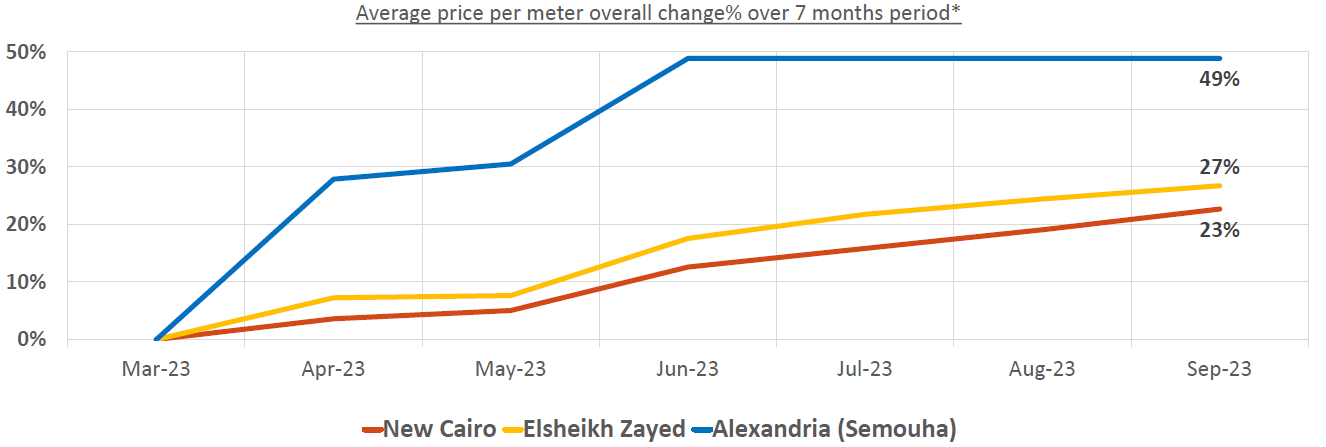

Real Estate: Accommodation

Real estate developers are recording record sales figures in 2023 fewer units are being sold, but they’re going for much higher prices. Rising construction costs have prompted developers to jack up prices, and while they’re finding fewer buyers in absolute terms, there are still plenty of would-be homeowners in the market with excess EGP looking for a hedge against future devaluation.

The rental prices sharp rise amid the Sudanese moves is slowly smoothening with rental prices inching back to normal rates during the end of Summer.

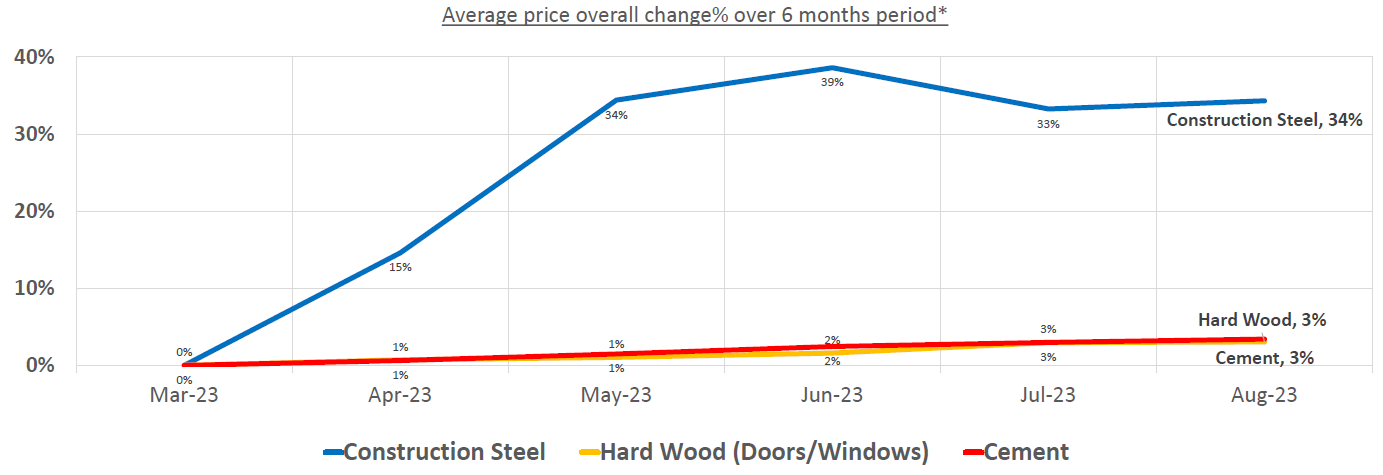

Real Estate: Construction

The cost of steel continues to be the only driver of the construction cost increase as other materials price changes are slowing down through the year.

The real estate market is exposed to increased raw material and building costs on the back of inflation and import hurdles. Developers are rushing to build their projects as fast as possible to mitigate many risks.

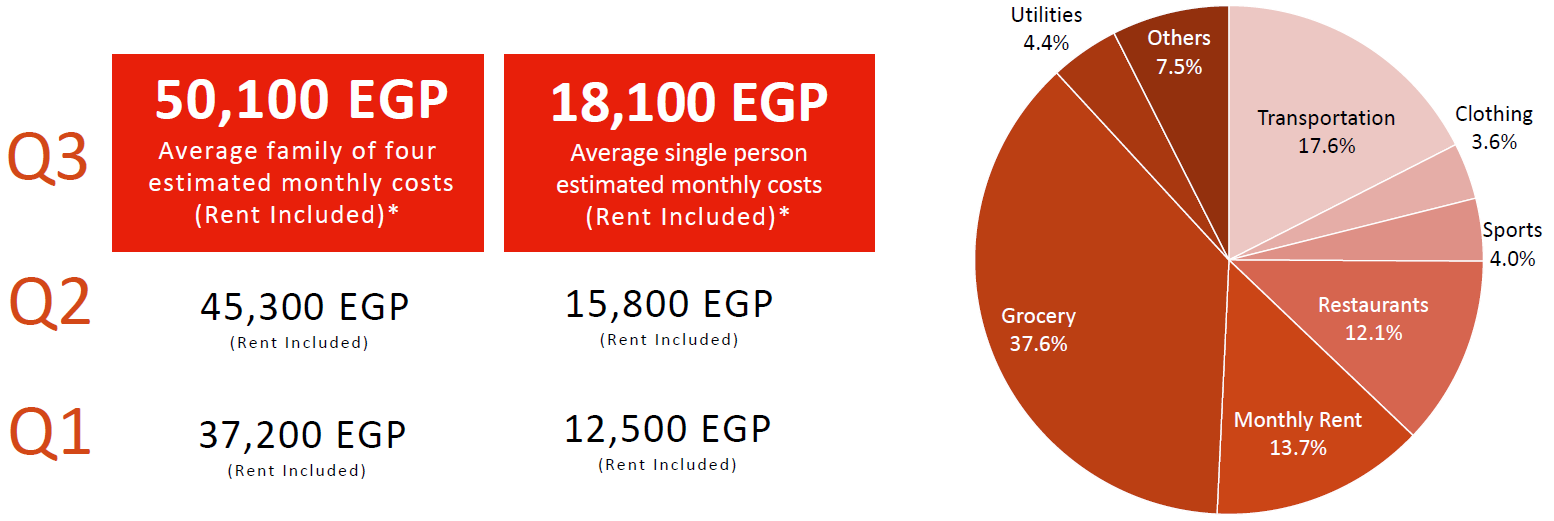

Cost of Living

The cost of living still continues to rise, driven by inflation, especially within food and beverage items. Business leaders and the Madbouly government agreed to reduce the prices of ten key food items by 15 25 % to tackle soaring food price inflation and ease the burden of the cost of living crisis.

We have revisited the average cost of living for families and Individuals and the breakdown of their spending, consumers are giving up leisure spending like restaurants and clothing purchases to keep up with rising costs.

Make sure not to miss out on the upcoming Target HR services report for Q4. Stay tuned for comprehensive insights and valuable information that will provide a detailed overview of our achievements, strategies, and noteworthy developments during the fourth quarter.